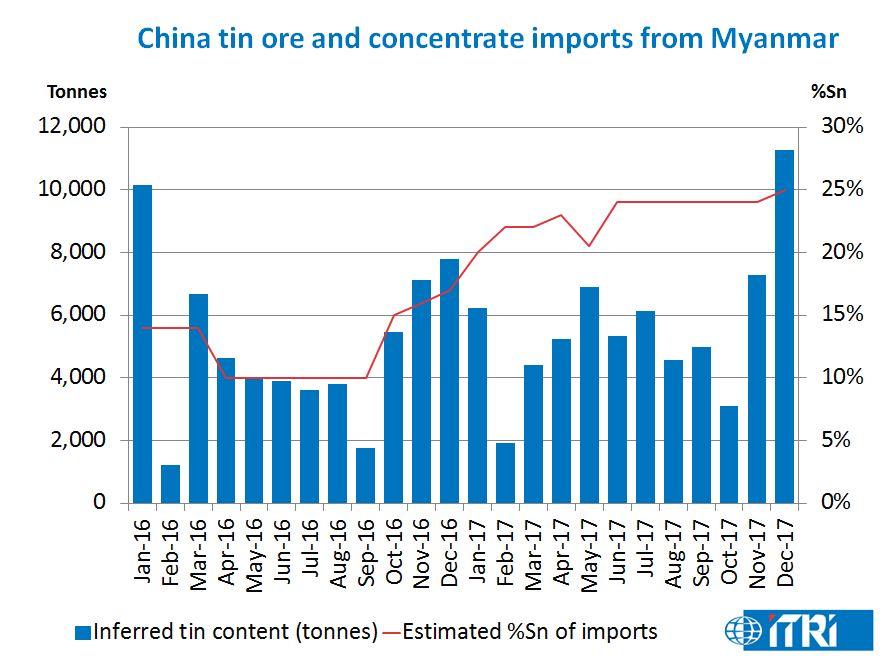

According to the latest customs statistics, China’s tin ore and concentrates imports in December 2017 totalled 45,295 tonnes, 45,020 tonnes of which originated from Myanmar. We estimate that the tin content of shipments from Myanmar in December was 11,300 tonnes, 4,000 tonnes more than November and the highest in 2017.

Tin metal content of ores and concentrates from Myanmar totalled some 67,500 tonnes in 2017, up 12% year-on-year. The trade data also reports refined tin and alloy exports in December totalled 10 tonnes, while 335 tonnes of tin products were export. Reported Chinese exports of refined tin and alloys in 2017 totalled 2,181 tonnes, almost treble the 2016 total, while reported tin product exports in 2017 totalled 5,574 tonnes, completely unchanged from 2016.

Our View: Pressure on traders and mining companies in Myanmar to sell concentrate stocks to pay worker salaries and debt before the Chinese Spring Festival in mid-February as well as the sale of 2,000-3,000 tonnes of tin-in-concentrate from local Wa government stocks both contributed to a record monthly shipment volume for the year in December. Looking forward, the high level of shipments from Myanmar reported in 2017 will be difficult to sustain in 2018 unless new ore deposits are discovered locally. Current shipments mainly rely on re-mining of old open pits (1.2~1.5% Sn grade), processing of tailings (~0.5%Sn grade) and depletion of locally held stocks. Local miners, as well as Chinese traders, investors and smelters, are consistent in the belief that shipments will decline in 2018; although there are different opinions regarding how far shipments could fall. Our preliminary forecast of Myanmar’s shipments to China in 2018 is 54,000 tonnes, though subject to a wide margin of error.