In view of becoming Australia’s second largest tin producer, Stellar Resources has announced the results of its Heemskirk Tin Project Scoping Study. Development of the project will include an underground mine, processing plant, and a tailings storage facility, and it is expected to produce around 2,200 tonnes of tin-in-concentrate per year of its 11 year mine life.

Although the current tin market is not healthy, forecasts for the medium-term future are still particularly positive with demand for tin expected to increase due to requirements for tin, in the form of solder, in new technologies such as 5G, Internet of Things and lithium-ion batteries. Given this, new mines will be needed to supply this new demand; Stellar Resources are looking to lay the groundwork for the Heemskirk project now in order to position the start of operations just as this new demand stimulus kicks in.

Stellar Resources has always advertised the Heemskirk project as being very similar to the long-life Renison Bell mine, located just 18 km north-east of Heemskirk. The two mines share the same ore genesis and similar geology, and so Stellar is hopeful that the two will have similar resources. Although the tin identified at Heemskirk is only 20% of that found at Renison to date, the two mines are also similar in cost, according to the Scoping Study.

Assuming a long-term tin price of around US$ 20,000/tonne, the total operating cost of Heemskirk is estimated at around US$ 13,100/tonne tin. This is around US$ 2,000/tonne higher than Renison’s current operating cost, which sat at around US$ 11,600/tonne tin according to Metals X’s June report, but allows Stellar to operate with a 34% margin. According to the company’s sensitivity analysis, the Heemskirk project would only be uneconomical if the AUD:USD exchange rate flared out to 0.76 (average 0.7) and the tin price remained at US$ 16,000/tonne. However, as Stellar points out, this would make most tin producers uneconomic and is relatively unlikely, especially given the current strength in the US dollar.

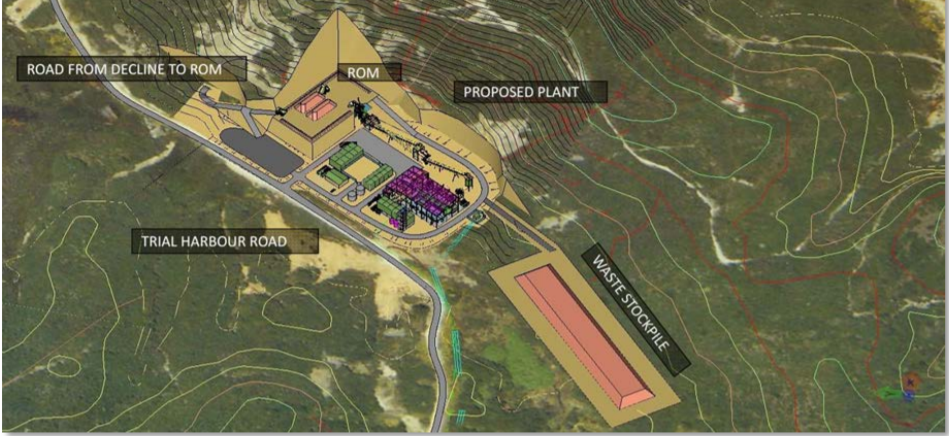

The initial mine will incorporate the Queen Hill and Severn tin deposits, just two of the four potential Heemskirk deposits, producing around 350 tonnes of tin ore per year over a ten year mine life. This will then be processed on-site before being exported through the nearby port of Burnie to smelters in South East Asia. The processing flow sheet for the Heemskirk project is slightly complicated by the inclusion of sulphide flotation, although these minerals only contain around 3% of the total tin. It is estimated that a 48% Sn concentrate can be produced with a 73% recovery, although the Life-of-Mine estimate for recovery is 69.4% over the full eleven years due to the inclusion of the St Dizier satellite deposit. In the final year of the mine plan, processed ore will be entirely from the St Dizier deposit which is higher in sulphides, reducing the average recovery. However, Stellar sees the deposit as a low cost opportunity and is looking to explore its development.

Now that Stellar has proven the robust economics of the project, what’s next at Heemskirk? Stellar are looking to define a 3.3Mt resource at the Queen Hill and Severn deposits, with a 100% Indicated Mineral Resource, which would then be followed up by a Pre-Feasibility Study. After this, further drilling will be required to define the reserve at Queen Hill and Severn to cover the first 2-3 years of mine production, and this can be followed up by a Bankable Feasibility Study. With everything include, Stellar estimates that production from the Heemskirk Tin Project will begin in approximately 3 years (subject to the availability of funding and any unforeseen delays).

Our view: With a possible technology and green energy revolution on the horizon, Stellar appear well-positioned to begin production in time to the fill the possible tin deficit that could result from the increased demand. At a competitive All-In Sustaining Cost of US$ 13,100/tonne tin, this puts the Heemskirk project in the lower half of the cost curve for tin production, with the possible upside of the inclusion of ore-sorting technology still to be explored fully. Initial test work has been positive according to Stellar, and it is likely that the technology will be added in the future.