The latest statistical data released by the Bolivian government has indicated the severe impact of the coronavirus on tin mining and smelting in the country during the first quarter of 2020.

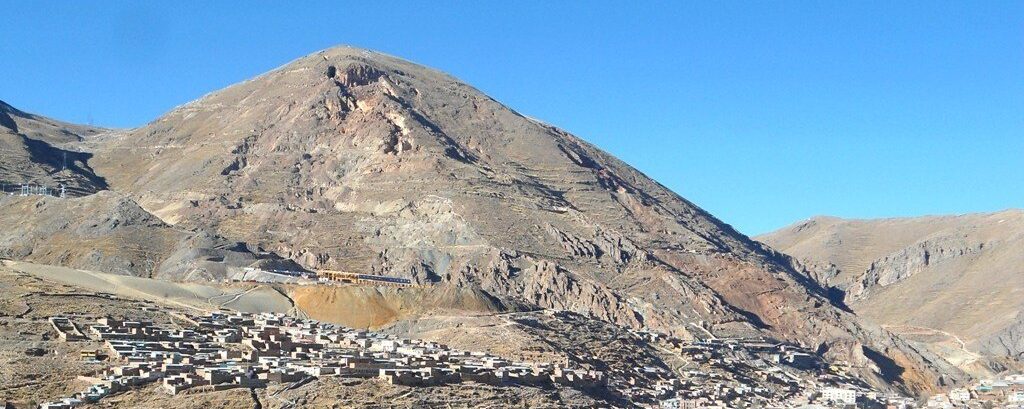

Mining in the country is conducted by the two mines owned by the state mining organisation COMIBOL, as well as smaller mines and cooperatives. The state-owned Huanuni and Colquiri mines produced some 3,366 tonnes of tin concentrate during the first quarter. Other operations produced a combined 2,489 tonnes.

Total tin concentrate production (5,855 tonnes) was down some 30% year-on-year (YoY). In late March, it was announced that mining operations in the country would be locked down due to the outbreak of the coronavirus.

In terms of refined tin production, the state smelter EM Vinto produced some 2,890 tonnes in the first quarter. This represented 73% of the total refined tin produced in Bolivia during that period. Smelters were also subject to restrictions beginning at the end of March, reducing output. Despite this, total refined tin production in the country was some 14% higher than in 2019.

However, data for the second quarter indicated a significant decline in smelter output. During the peak of coronavirus restrictions in the country, total refined tin production was 1,321 tonnes. This was a decline of nearly 66% quarter-on-quarter and 69% YoY.

Weak demand and lower production in the first half of 2020 saw exports of refined tin from Bolivia fall some 31.7%. 5,171 tonnes of tin were exported from Bolivia in 2020, compared to 7,574 tonnes exported across the same period in 2019. Of the total exported in 2020, EM Vinto sold 3,759 tonnes: some 73%. The United States was the most significant destination, taking 40% of the metal by value.

| Q1 data, tonnes | State Companies | Private Companies | Cooperatives | Total | |

| Tin Concentrate Production | 3,366 | 111 | 2,378 | 5,855 | |

| Refined Tin Production | 2,890 | 964 | 0 | 3,854 | |

| Refined Tin Exports | 3,759 | 1,412 | 0 | 5,171 | |

Our view: Even without coronavirus restrictions, it is estimated that mined tin production in the country would have been significantly lower than in 2019. Based on 2019 annual production, it is estimated that the mine closures removed around 900 tonnes of tin concentrate from the market. Total production would therefore have been around 6,900 tonnes without the lockdown, some 1,500 tonnes lower than in 2019. We expect official Q2 data to show an even greater decline in mine production due to the continued and longer-lasting lockdown measured imposed.

For refined tin production, however, coronavirus-related closures appear to have held back forecast growth.

In Q1, it is estimated that the smelter closures removed roughly 550 tonnes of refined tin from the market. Had the smelters not been forced to close, total Bolivian production in the quarter could have been some 4,400 tonnes, an increase of around 31% YoY.

In Q2, continued closures prevented production of around 2,600 tonnes of refined tin. Yet even with this potential production, smelter output would have still been some 7% lower YoY.

Overall H1 refined production, however, could have increased by some 9% YoY without lockdown restrictions. This is a significant difference compared to the real 32% YoY decline seen in H1 2020.