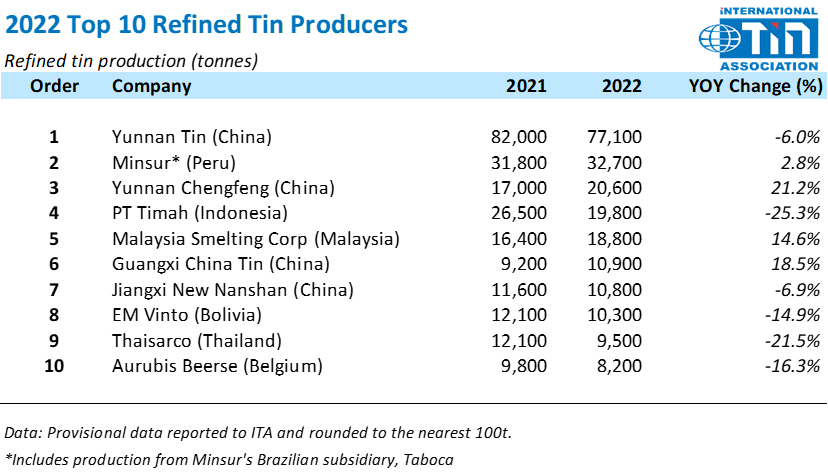

2022 saw refined tin production remain steady from the previous year. However, performance varied from company to company.

Yunnan Tin Company maintained its position as the world’s largest producer of refined tin, while other Chinese companies shuffled up the rankings. After a turbulent year in Indonesia, production at PT Timah fell significantly compared with 2021. Overall, global refined tin production is estimated to have reached 380,400 tonnes, up 0.3% on last year’s total of 379,400 tonnes.

ITA surveys global tin smelters to compile the annual list of the world’s largest producers. In 2022, these top 10 companies produced 56% of the world’s tin, down from 59% in 2021. As previously mentioned, the part of the drop in the group’s output can be attributed to the difficult year had by PT Timah. However, a significant decline in output from YTC also contributed.

Chinese smelters maintained overall production during 2022, despite challenges. Around 90% of production was shuttered in Q3 as smelters brought forward maintenance on falling prices and low demand. Meanwhile a wide arbitrage led to surging refined tin imports. Concentrate imports were also up year-on-year. Producers in South America maintained production off a strong baseline in 2021. European secondary production dropped as a result of a challenging Q4.

Our view: Despite a poor macroeconomic environment impacting demand, world tin production has remained steady in 2022. We expect a marginal increase in production in 2023, as positivity from China reopening is weighed down with challenges in Indonesia and South America.