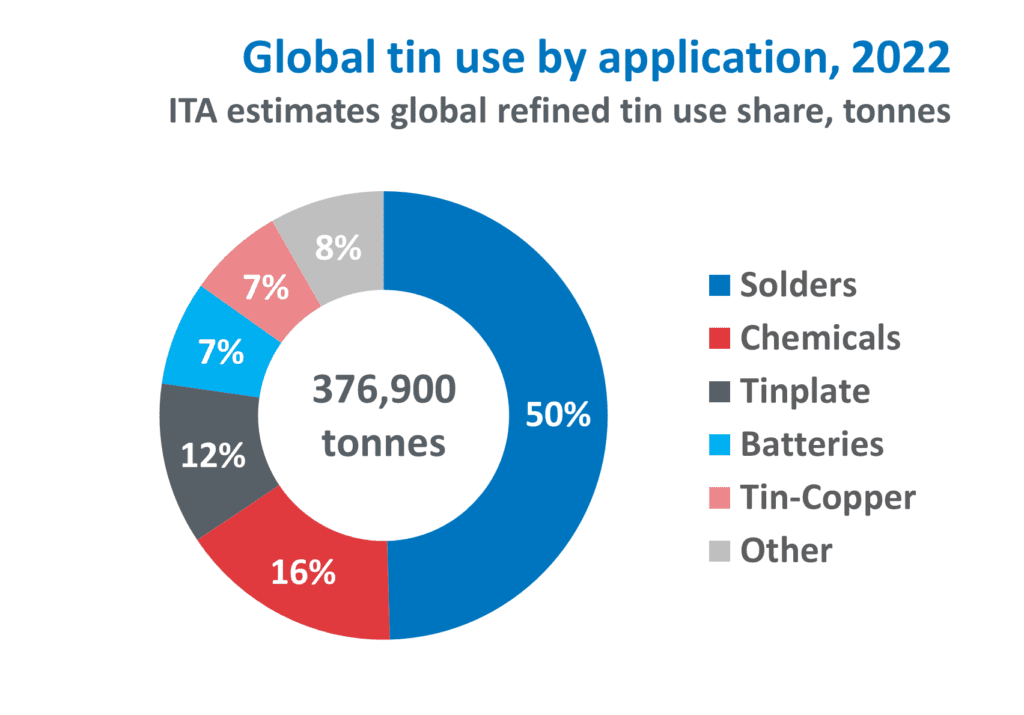

The nineteenth annual survey of tin users carried out by the International Tin Association (ITA) estimated that refined tin use in 2022 decreased -3.2% to 376,900 tonnes, lower than the preliminary -0.6% estimate made by participants in last year’s Q2/Q3 survey. The YoY decrease represents an overcorrection of the 2021 pandemic recovery bounce mostly related to rapidly rising inflation in the second half of the year.

The survey suggests a continued contraction in tin demand of -1.6% during 2023 to 371,000 tonnes as negative effects of inflation are balanced by technology boosts for tin in solar panels, electric vehicles and digitalisation. Multiple macroeconomic factors have negatively impacted projected tin demand, reversing much of the 2021 recovery.

84 companies took part in this year’s study, accounting for some 42% of estimated global refined tin use in 2022.

Refined tin stocks held by surveyed companies at the end of 2022 amounted to the equivalent of 3.8 weeks’ supply. Extrapolating to global consumption implies that world consumer stock holdings were around 30,100 tonnes. Consumer stocks were lower through much of 2021, but more ample supply towards the end of the year enabled a recovery, giving an increase from 2.6 weeks in 2021. Forecasts for 2023 suggest that consumers are destocked on weak demand and high interest rates; held stock is forecast to fall to an estimated 2.9 weeks’ supply.

Provisional estimates of total global tin use, including refined and unrefined forms, totalled 432,000 tonnes in 2022, down -2.1% from 2021. The Recycling Input Rate (RIR) was calculated to be 29.4% in 2022 and is forecast to increase slightly to 30.5% in 2023.

Solder still accounts for the largest global share of tin use, increasing marginally to 50% in 2022. Global average decline of refined tin use in this sector was -1.8%, with a larger effect outside China. 2023 forecasts reflect a stronger than expected performance, balancing losses in consumer segments with gains in technology and industry sectors to a flat 0.4%, marginally higher in China. Solar ribbon now represents around 12% of solder production and is emerging as a major new use. Respondents are optimistic about longer-term prospects for increased use in solar, 5G, electric vehicles, and other new technologies.

The average proportion of lead-free solders in electronics was estimated at 86% globally in 2022, similar to 2021. 78% of tin use globally in lead-free solders was specified at <100ppm Pb, recovered from a dip of 65% the previous year. The trend toward higher-purity, lower-lead specifications in tinplate continued to be reflected in 2022, as 54% of refined tin specified by reporting participants in the limited sample was <25ppm Pb, with an additional respondent reporting plans to shift to that level.

In chemicals, tin use by survey participants decreased by -5.5% in 2022 and was forecast to decline further by -4.9% in 2023. This sector, normally in steady growth, had been slow to recover from the pandemic and was further impacted by the economic downturn, especially for applications in the struggling property sector in China.

Tinplate data suggest this sector was hardest hit by recent macroeconomics falling sharply from boosted growth in 2020/2021 to a -7.5% decline in 2022 and a forecasted -4.2% decline in 2023. Canned food use gained traction during pandemic lockdown but other factors such as poor food harvests may have dominated.

Lead-acid battery tin use was significantly down from strong forecasted growth to decline -0.3% in 2022 but expected to resume growth at 2.3% in 2023. The sector is especially strong in China, where e-bike markets are still expanding. There are some losses from lithium-ion battery substitution but new lead-carbon lead-acid technologies are gaining some share. Tin intensity in start-stop hybrid vehicles also supports growth.

Tin use in tin-copper markets retrenched sharply from a double-figure pandemic recovery to decline -7.1% in 2022, with further decline of -3.9% forecasted for 2023. The sector dynamics are complex with multiple product types. Boosts from renewable energy sectors are balanced against large volume commodity segments such as construction that have been especially impacted by macroeconomics.

Other traditional metal product markets continued to recover from significant pandemic lows, roughly as forecast, to 0.6% growth in 2022, although are estimated to decline again by -5.0% in 2023. Use segments are diverse, ranging from consumer-related pewter products to industrial bearings and powders.