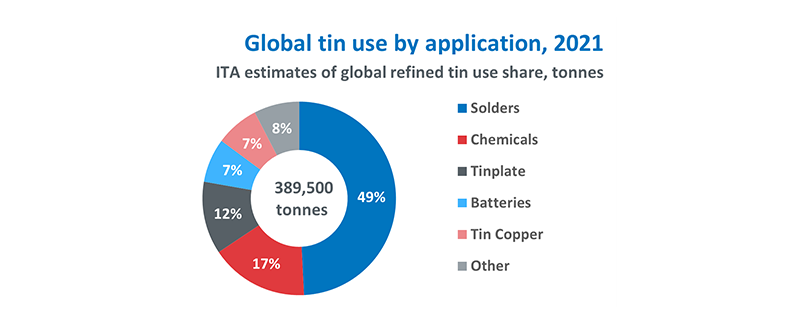

The eighteenth annual survey of tin users carried out by the International Tin Association (ITA) estimated that refined tin use in 2021 increased 7.6% to 389,500 tonnes with a strong recovery to pre-trade war highs.

However, estimates showed expected 2022 growth stalling below previous forecasts of 3-4% towards -0.6%. High inflation unexpectedly impacted demand in H2.

128 companies took part in this year’s study, accounting for some 46% of estimated global refined tin use in 2021.

Provisional estimates of total global tin use, including refined and unrefined forms, totalled 436,100 tonnes in 2021, up 3.9% from 2020. The Recycling Input Rate (RIR) was calculated to be 28.2% in 2021 and is forecast to increase slightly to 28.5% in 2022.

Refined tin stocks held by surveyed companies at the end of 2021 amounted to the equivalent of 2.7 weeks’ supply. Extrapolating to global consumption implies that world consumer stock holdings were around 20,400 tonnes. Consumer stocks were lower through much of 2021, but more ample supply towards the end of the year enabled a recovery, giving a net slight decrease from 2.9 weeks in 2020. Forecasts for 2022 suggest that consumers are looking to destock as demand falters; held stock is forecast to fall to an estimated 2.2 weeks’ supply.

Solder still accounts for the largest global share of tin use, increasing slightly to 49% in 2021. Global average growth of refined tin use in this sector was 12.2%. 2022 forecasts reflect the impact of inflation on consumer segments: an average decrease of -3.7% is expected globally, with a larger effect in China. Solar ribbon now represents 10% of solder production and is emerging as a major new use. Respondents are still optimistic about longer-term prospects for increased use in solar, 5G, electric vehicles, and other new technologies.

The average proportion of lead-free solders in electronics grew to 86% globally in 2021, up from 80% in 2020. 65% of tin use globally in lead-free solders was specified at <100ppm Pb, down from 82%. The trend toward higher-purity, lower-lead specifications in tinplate continued in 2021, as 95% of refined tin specified by reporting participants was <50ppm Pb, a marked shift from 79% in 2020.

In chemicals, tin use by survey participants increased by 4.0% in 2021 and was forecast to grow by 4.9% in 2022. Market dynamics in this sector have been complex through the pandemic, with both positive and negative effects in different sectors. This data reflects broad recoveries continuing through 2022, with China markets weakened by its ongoing property crisis.

Pandemic-boosted tin use growth in tinplate markets continued through 2021 at 5.2%. Participants forecasted this higher baseline to be maintained with a modest 0.3% growth in 2022. Some turbulence can be expected with both positive and negative effects possible in relation to forecasted food market disruption.

Lead-acid battery tin use markets reflected a significant pandemic boost to e-bike use in China as well as some recovery in auto markets, growing by 6.9% in 2021 and forecast at 7.6% growth in 2022. Tin intensity increases in start-stop hybrid vehicles and other advanced batteries are also supporting growth. Markets will continue to grow steadily in the medium-term despite ongoing development of lithium-ion and other technologies.

Tin use in tin-copper markets increased significantly in 2021, with global growth of 15.8% reflecting pandemic recovery supported by new technology markets including electric vehicles and new electrical infrastructures. Negative growth forecasts for 2022 at -9.2% are mainly based on the cost-of-living crisis.

Other traditional metal product markets averaged a -4.4% decline in 2021, largely rebalancing a large 2020 boost from float glass installations in China. Outside of China, markets showed some recovery. Markets are expected to resume a steady 1.2% growth in 2022.