The sixteenth annual survey carried out by the International Tin Association (ITA) estimated a tin use contraction of -5.4% in 2019 with a further decline of -5.9% forecast for 2020. However, it was not all bad news for tin as some sectors actually benefitted from the pandemic. 121 companies took part, accounting for some 48% of estimated global refined tin use in 2019.

The sixteenth annual survey carried out by the International Tin Association (ITA) estimated a tin use contraction of -5.4% in 2019 with a further decline of -5.9% forecast for 2020. However, it was not all bad news for tin as some sectors actually benefitted from the pandemic. 121 companies took part, accounting for some 48% of estimated global refined tin use in 2019.

Key headline findings from the report are as follows:

ITA’s latest estimate is that refined tin use in 2019 decreased -5.4% to 359,200 tonnes, based on data from the 2020 survey and trade data. The figure is lower than the preliminary -1.8% estimate made by participants in last year’s Q2\Q3 survey. The survey suggests a further contraction in tin demand of -5.9% during 2020, primarily attributed to the COVID-19 pandemic. More recent data indicates a stronger than expected Q3\Q4 China recovery.

Refined tin stocks held by surveyed companies at the end of 2019 amounted to the equivalent of 3.0 weeks’ supply. If this ratio is extrapolated based on global consumption, it would imply that world consumer stock holdings were around 21,000 tonnes. Compared to data from 2018 and forecasts for 2020, consumer stocks dipped in 2019; forecasts for 2020 suggest that consumers are rebuilding stocks.

Provisional estimates of total global tin use, including refined and unrefined forms, totalled 427,400 tonnes in 2019, down -5.8% from 2018. The Recycling Input Rate (RIR) was calculated to be 30.0% in 2019 and is forecast to fall slightly to 29.2% in 2020.

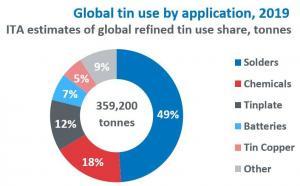

Solder still accounts for the largest global share of tin use, increasing slightly to 49% in 2020. Forecasts for 2020 indicate global average decline of -8.1% related to the COVID-19 pandemic, with China being much more positive. Some electronics use sectors were boosted by increased working and education from home. Electronics supply chain restructuring accelerated by the pandemic as well as rising geopolitical tensions were a major focus for respondents. Most saw major opportunities for solder growth in future 5G related markets.

The average proportion of lead-free solders in electronics grew to 77% globally in 2020, up from last year. 72% of specified tin use globally in lead-free solders was <100ppm Pb. The trend toward higher-purity, lower-lead specifications in tinplate continued in 2019, as 45% of refined tin used was <50ppm Pb, up from 35% in 2018.

In chemicals, tin use by survey participants declined by -3.4% in 2019 and was forecast to fall by a further -9.2% in 2020. China markets were particularly impacted by the pandemic, with more positive feedback from the US where markets are being boosted by residential construction related to an exodus away from cities.

Tinplate use continued a long-term trend of being static or in decline, falling in the survey sample by -6.7% in 2019. However, 2020 use was forecast by participants to increase by 7.0% in 2020 due to increased consumer canned food purchasing during the COVID-19 pandemic, especially outside China. Price still pressures tin use in this otherwise static market with some competition from alternative packaging challenging growth.

Lead-acid battery tin use survey data saw little effect of the pandemic, growing by 2.0% in 2019 and 3.0% in 2020. Battery use was boosted for several reasons during the pandemic. Use in E-bikes in China is a significant proportion of tin use where competition from lithium-ion has not yet had a significant effect and could be reversed by the public choosing not to use public transport. Further tin use growth is expected as conversion to start-stop cars and trucks requires high performance.

Tin use in copper alloys and other metal product markets declined by -6% in 2019 with further decline of -10% forecasted for 2020. The sector was hit hard by COVID-19 especially affected by automotive, engineering and giftware sectors. Respondents were especially uncertain about future prospects, although increased use in float glass in China boosted 2020 forecasts.