Chinese tin smelters have been cutting back refined production in Q4 and scheduling maintenance because of a shortage of suitable concentrate.

The most significant driver has been a decline in Myanmar’s tin concentrate shipments this year, which account for 40 percent of China’s raw material supply. Stocks of tin-concentrate in have been drawn down since March but this largely ended in August as the large quantity of raw material inventory in the warehouses of China and Myanmar ports was exhausted. The ongoing relocation of ore processing plants in Yunnan has also led to reduced availability of high-grade concentrate, which is needed to blend with lower grade material. Smelting and processing fees continue to fall dramatically, with the tolling charge for 40 %Sn tin concentrates falling from 17,000 yuan per tonne to 14,000 yuan per tonne, and for 60%Sn concentrates from 12,000 yuan per tonne to 10,000 yuan per tonne as of mid-November.

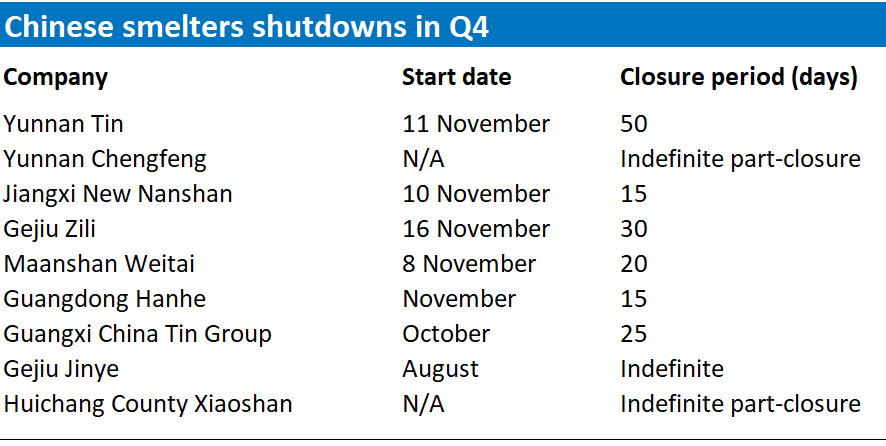

Some Chinese smelters have partially closed or closed entirely in Q4 in response to the situation while others, like Yunnan Tin Company, have scheduled maintenance of their plants. The shutdowns could reduce monthly Chinese output of refined tin by 4,000 tonnes in November and 5,000 tonnes in December. It is estimated that domestic refined tin output in 2018 will decline by about 8% year-on-year and in the in the fourth quarter will decline by 29% year-on-year, and 18% quarter-on-quarter.

Our view: Smelters in China are braced for a difficult winter, especially in Yunnan Province, with lower monthly shipments of Myanmar concentrate expected to continue. Many smelters in Yunnan are on the brink of profitability, although the situation is better for smelters in other provinces. Tin concentrate availability is expected to intensify towards the end of 2018 and the situation could worsen in early 2019 if there are issues with domestic processing plant relocations or further declines in Myanmar tin mining output.