At a tin price of US$ 19,750, Oropesa could generate annual profit of around US$ 20 million from the 2,440 tonnes of tin-in-concentrate. Oropesa would operate at a cash cost of US$ 11,534/tonne of tin.

According to Elementos Chairman Mr Andy Greig, “the study demonstrates that Oropesa has the potential to deliver attractive financial returns at a relatively low capital cost”.

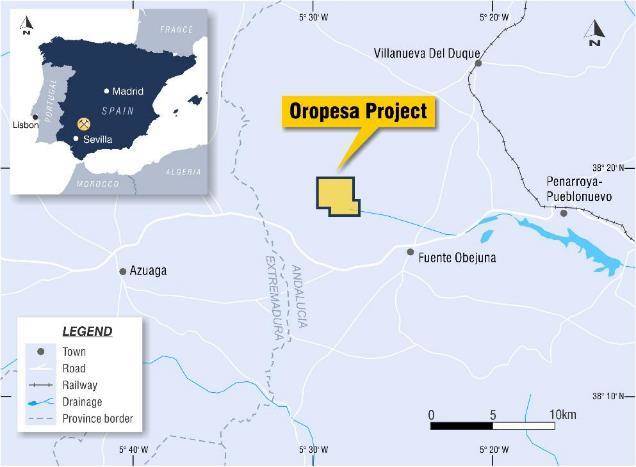

Elementos first defined an exploration target at its Oropesa project in early 2019. At the time, the company expected to find 35.5 – 51 million tonnes of ore grading between 0.46% and 0.62% Sn.

According to the latest release, the project has a JORC Resource of 12.54 Mt at 0.54% Sn for roughly 68,000 tonnes of tin. While this is lower than the original exploration target, this uses a cut-off grade of 0.15% Sn.

The report estimates that around US$ 52 million will need to be invested before mining can begin. This initial CAPEX puts Oropesa at the lower end of the tin project CAPEX curve.

Once construction is completed, Elementos estimates that it will take around 4 years to reach full production. At nameplate capacity, 750,000 tonnes of ore will processed each year to produce a 62% tin concentrate.

The next steps for Oropesa are to complete a Definitive Feasibility Study and to finalise environmental permits. The company is also planning “further drilling to expand and upgrade the size of the existing resource and lower the overall waste-to-ore ratio for the project”.

Our view: With a reported full cost of around US$ 13,500/tonne, Oropesa sits at the lower half of the tin cost curve. Yet, according to the report, the mine would need a tin price of US$ 19,750 to achieve its targeted revenue.

Although tin prices are currently experiencing a downturn due to the coronavirus outbreak, we believe that prices will rebound in the medium-term future due to increasing demand and low investment in mine projects.