2020 was a difficult year for tin producers. In many countries, the spread of the coronavirus saw lockdown measures that closed smelters and halted production.

In total, ITA estimates that 327,200 tonnes of refined tin were produced in 2020. This was a nearly 8% drop in production compared to 2019 levels, which had already fallen some 5% from 2018.

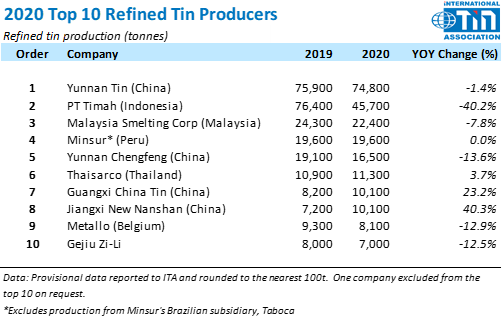

ITA also surveys global tin smelters to compile the annual list of the world’s largest producers. In 2020, these top 10 companies produced 69% of the world’s tin, down from 76% in 2019.

The drop in output from the group can be primarily attributed to the significant decline in production from PT Timah. The company more than doubled production in 2019 after export regulations forced many of the country’s private smelters to cease operations. According to PT Timah’s annual report, some of these smelters were rented to the company, increasing their capacity significantly. However, many private smelters have resumed production, likely ending this deal with PT Timah.

In China, production began the year slowly as the coronavirus impacted raw materials supply. However, the larger companies in the top 10 were able to ride out the disruptions. As a result of the changes in Indonesia, Yunnan Tin retook the top spot on the list.

South America was significantly impacted by the coronavirus, with smelters in Brazil, Peru, and Bolivia closed for an average of two months in the early part of the year. The lengthy closure of EM Vinto (Bolivia) saw it move out of the top 10 for the for the first time. A full year of production from the new B2 tailings reprocessing plant enabled Minsur to keep production steady year-on-year despite the disruptions.

Our view: It is unlikely that we will see another year quite like 2020. Enforced smelter closures are not common normally, but synchronous stoppages across the world are unheard of.

Most smelters now have extensive safety measures in place to prevent COVID entering the plants, and so we feel it is unlikely that further waves of the virus could prevent production for significant periods. With that in mind, we forecast a rebound in refined tin production in 2021 back to 2019 levels.