On Wednesday, tin hit an all-time-high on the LME, with the 3-month contract closing at US$53,462 per tonne.

While the market has been in a prolonged deficit due to a series of protracted supply disruptions, ITA understands that the metal’s fundamentals are not the primary driver of the recent price rally.

Over the past two years, the tin price has been increasingly controlled by factors other than core fundamentals.

The supply disruptions affecting Myanmar and DR Congo remain largely unchanged from three months ago, but increased investor activity, particularly in China, have pushed prices higher.

In Indonesia, exports have halted in the new year given the seasonal cycle of export permit renewals. ITA expects the disruption to be limited as regulators will honour existing three-year RKAB mining and smelting licences until the end of March 2026.

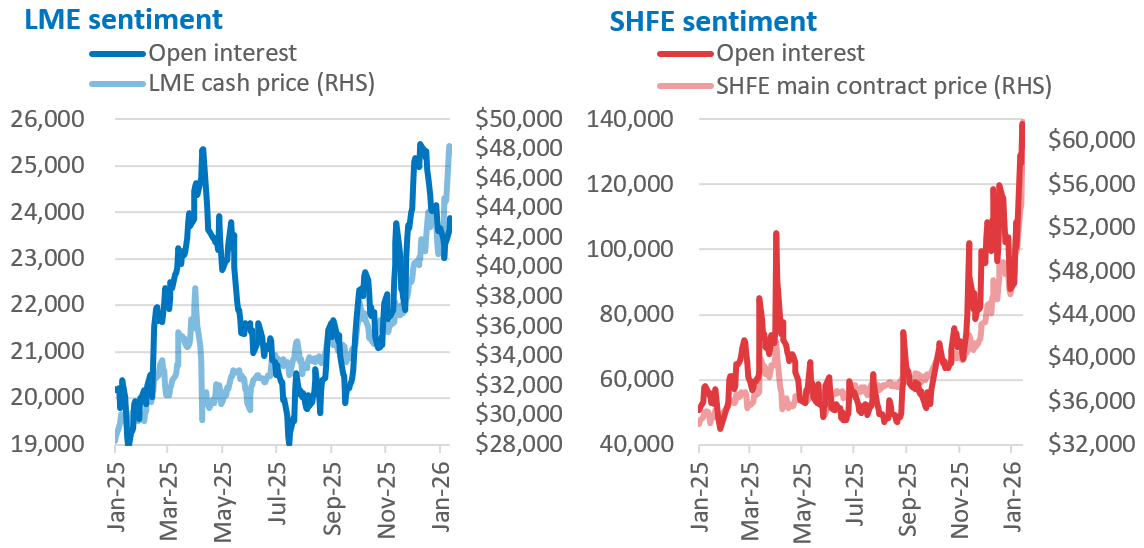

LME and SHFE data demonstrate a gradual rise in open interest over December and then a sharp increase on the SHFE over the past two weeks, corresponding with the price surge.

The price is also currently buoyed by a broader uplift in the base metals complex amid heightened global tensions and a weakening US dollar.

As a relatively small and illiquid market compared with other base metals, tin is particularly susceptible to the influence of investment funds, which can drive pronounced price volatility. While these flows provide additional liquidity, market participants have raised concerns about the undue role of financial institutions.

In this context, the Chinese Nonferrous Metals Industry Association (CNIA) stated in late December that the recent price rally was “unreasonable” and urged speculators to exercise caution.

Periods of heightened speculative influence increase the risk of sharp price corrections as positions are unwound, particularly when underlying fundamentals imply materially lower price support.

ITA continues to track relevant disruption events and is following developments closely.